Contributions to Traditional 401ks reduce your taxable income in the year you make the

contribution. Many people enjoy lowering their annual tax burden this way while saving for their

retirement. Contributions to a Traditional IRA can be tax deductible providing a similar tax benefit.

But what about when the taxes are due on those funds?

For years, a common refrain has been “don’t worry, your taxes will be lower in retirement!”. In

retirement, the argument goes, you’ll have fewer expenses, so you’ll need less income, so you’ll be in a

lower tax bracket. That makes sense. As long as nothing about your situation, or the world around you

changes in the decades between when you make those contributions and when you pull those funds

out.

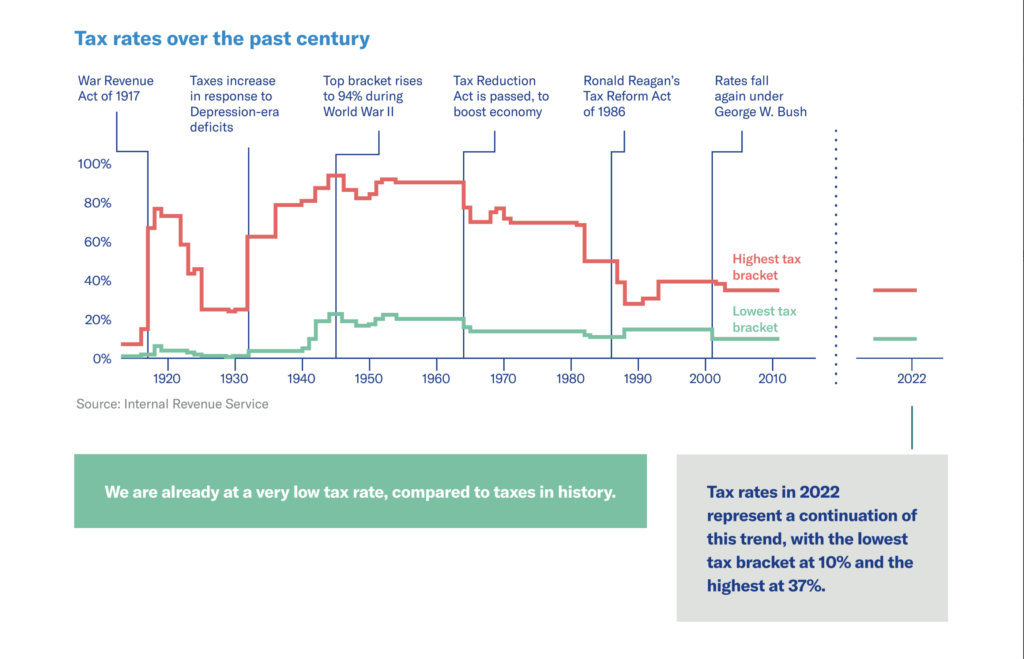

What kind of things might change? Let’s start with the graphic at the top of this article.

Historically, our current income tax environment is below that of many other periods. While we don’t

think about it often, income tax law, and brackets, change periodically. When that happens, your tax

bracket could change, even if your income doesn’t. And when you consider the cost of Social Security,

Medicare/Medicaid and other government obligations, it’s easy to see why tax rates might go up in the

coming years.

It’s possible that in retirement, your lowering income could collide with a rising tax bracket

leaving you in the same tax situation you are now. You might argue that you’re no worse off then.

Paying the same tax now, or then, is a wash. Fair enough. But what about all the growth in the

account? Decades of interest, dividends and capital gains are all now fully taxable when you draw them

out for the rest of your life. Maybe not the ideal scenario.

If you believe, as I do, that taxes will go up, you might want to consider forgoing a tax benefit

now, in your earning years, for the benefit of your retirement-self. Your contributions will be no worse

off when you need them but all the interest, dividends, and capital gains which could be the larger

portion of your account, will also be available tax-free.

For a personalized conversation on how these factors apply to you and your family, feel free to

connect or message me for a complimentary 30 minute discussion.

Contributions to a traditional IRA may be tax deductible in the contribution year, with current

income tax due at withdrawal. Withdrawals prior to age 59 1⁄2 may result in a 10% IRS penalty tax in

addition to current income tax.

A Roth IRA offers tax deferral on any earnings in the account. Qualified withdrawals of earnings

from the account are tax-free. Withdrawals of earnings prior to age 59 1⁄2 or prior to the account being

opened for 5 years, whichever is later, may result in a 10% IRS penalty tax. Limitations and restrictions

may apply